The Tax System Secret: How Business Owners Play by Different Rules (And How You Can Too)

Have you ever wondered why some people seem to pay hardly any taxes while you’re writing massive checks to the IRS every April? It’s not luck, and it’s definitely not cheating. The truth is, there are two completely different tax systems in America, and most people are playing by the wrong set of rules. The […]

The 2026 HSA Law Changes Nobody’s Talking About: Your Guide to Saving $16,850 Tax-Free

Congress just handed you one of the most powerful wealth-building tools in decades, and chances are, your CPA hasn’t even mentioned it yet. The new 2026 HSA law represents a seismic shift in how American families can save on taxes while building long-term wealth through their health savings accounts. If you’re a business owner, entrepreneur, […]

Are You Overpaying Taxes? The Business Structure Mistake Costing You $10K-$30K Annually

Here’s something that keeps me up at night as a CPA: I meet business owners every single day who are unknowingly throwing away tens of thousands of dollars in taxes. And the frustrating part? Most of them have no idea it’s even happening. If you’re operating as a sole proprietorship or running a single-member LLC […]

The Backdoor Roth IRA Strategy Every High-Earning Business Owner Should Know Before Year-End

If you’re a successful business owner earning well into six figures, there’s a strong chance you’ve been shut out of contributing directly to a Roth IRA. And honestly? That rule blocks exactly the people who would benefit from it the most. Here’s the good news: you can still legally build tax-free retirement wealth—even if you […]

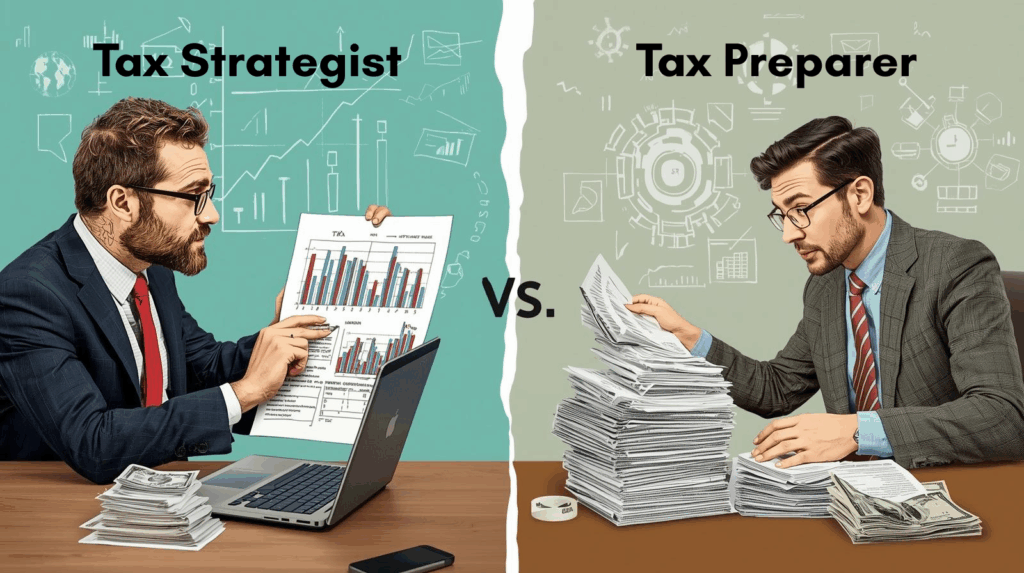

Tax Strategist vs. Tax Preparer: Why This One Distinction Can Save You Tens of Thousands Every Year

Most business owners work with a tax professional every year—but here’s the problem: they often work with the wrong type of tax professional without even realizing it. If you’ve ever felt like you’re overpaying in taxes, missing opportunities, or only talking to your CPA during tax season, you’re not alone. The truth is that tax […]

Advanced Tax Strategies the Ultra-Wealthy Use to Pay Almost Nothing in Taxes

What if I told you the ultra-wealthy aren’t just making more money — they’re keeping more of it? They use advanced tax strategies that allow them to legally reduce or even eliminate taxes while building long-term wealth. These aren’t basic deductions or tax hacks. These are the same techniques that private wealth managers charge tens […]

Turning W-2 Income into Tax-Free Wealth

If you could turn your W-2 income into tax-free wealth, would you want to know how? Most people think building wealth means earning more—but the truth is, it’s about keeping more of what you earn. One of the most powerful and misunderstood strategies in the entire IRS tax code is the Real Estate Professional Status […]

LLC vs S-Corp: The Smart Way to Save Thousands in Taxes

Most business owners are unknowingly throwing away thousands of dollars each year simply because they chose the wrong business structure. In fact, research shows that nearly 75% of entrepreneurs are either in the wrong entity altogether or not fully optimising the one they already have. And one of the biggest questions that keeps coming up […]

IRS 2025 Tax Form Changes: What Business Owners Must Know

Sometimes the IRS makes announcements that sound small but have big consequences for business owners. That’s exactly what happened on August 7th, 2024, when the IRS revealed that they will not update key tax forms for 2025. At first glance, this might not seem like a big deal. But if you employ people who earn […]

How To Prepare For Tax Season

Let’s tackle a topic that might not be at the forefront of your mind yet but is crucial for your business’s financial health: preparing for tax season and understanding the importance of tax accounting. I know, we’re only midway through 2024, and it might seem early to think about taxes. However, starting early can make […]