Made in America = Lower Taxes? The Truth About Trump’s New Tax Agenda

Lower Taxes – Running a small business is a thrilling adventure, but let’s be honest—it comes with its fair share of financial headaches. While you focus on growing your brand and keeping customers happy, financial missteps can sneak up and cause long-term damage. The good news? With the right knowledge, you can steer clear of […]

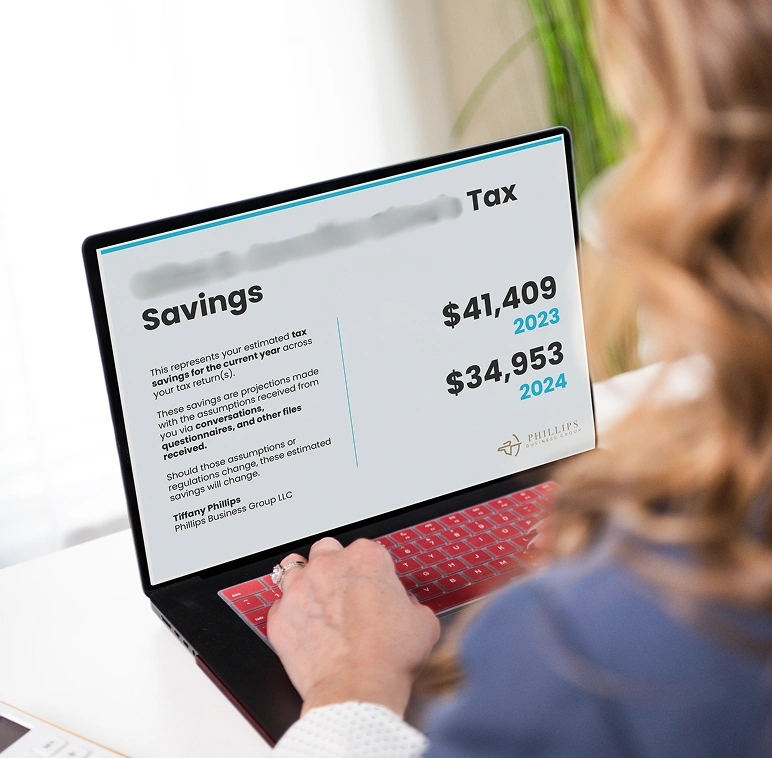

Stop Settling for Peanuts: The Tax Hack Your CPA Isn’t Telling You About

Tax Hack Your CPA – Running a small business isn’t just about passion—it’s also about making smart financial decisions that keep you afloat and growing. Whether you’re just starting out or have been in business for years, understanding how to manage your finances effectively is non-negotiable. Let’s dive into some of the most common financial […]

From VP to CEO: Lessons on Building a Thriving Business from Scratch with Guest Dr. Annie Cole

Starting a business is often portrayed as an exhilarating journey filled with fast growth and financial freedom. But the reality? It’s tough. It requires resilience, strategy, and most importantly—financial awareness. I recently had the pleasure of interviewing Dr. Annie Cole, a financial coach and the founder of Money Essentials for Women. In just under a […]

99.5% of Tax Laws Are Written to Help You—Here’s What CPAs Won’t Tell

Tax Laws Are Written – What if I told you that the U.S. tax code is actually designed to benefit you, not to drain your hard-earned money? It’s a truth that not enough business owners, entrepreneurs, and investors fully understand. The reality is, 99.5% of tax laws are written to help you reduce your taxes—not […]

The One Mistake Keeping Your Business from Explosive Growth in 2025

As we step into 2025, many of us have big goals for our businesses. Whether it’s scaling to new heights, expanding our services, or simply creating more balance, there’s one key strategy that could make all the difference: delegation. I know what you might be thinking because I’ve been there too: These thoughts held me […]

7 Strategies to Reduce Taxes When Facing a Long-Term Capital Gain

7 Strategies to Reduce Taxes When Facing a Long-Term Capital Gain – When it comes to selling a business, real estate, or any other large asset, many people don’t realize the significant tax implications until it’s too late. A unique life event like this—where there’s suddenly more income than usual—can create a hefty tax burden […]

Smart Debt Management for Small Business Owners

Smart Debt Management for Small Business Owners – Managing debt effectively is a crucial aspect of running a successful small business. Many business owners struggle with decisions about which debts to pay off first, whether to take on new loans or how best to utilize cash reserves. This guide provides practical steps to help you […]

After the Storm: Post-Tax Season Tips for a Prosperous Summer

Ah, tax season: that magical time of year when coffee consumption spikes and our desks become buried under mountains of paperwork. But now that the storm has passed and the last tax return has been filed, it’s time to sail into the calm waters of summer. I’m Tiffany Phillips, captain of the Phillips Business Group […]

Summer Forecast: Sunny Days Ahead with Streamlined Accounting

Ah, summer! A time for sun, sand, and… streamlined accounting? Absolutely! I’m Tiffany Phillips, the proud owner of Phillips Business Group, and I’m here to convince you that summer isn’t just for sipping margaritas by the pool (though that’s important too). It’s also the perfect season to get your accounting practices sleek, efficient, and dare […]

Spring Clean Your Finances: Post-Tax Season Strategies for Fresh Success

Spring Clean Your Finances: Post-Tax Season Strategies for Fresh Success– As the owner of Phillips Business Group, I have seen firsthand the aftermath of tax season—it’s like a season finale of your favorite drama series, but with more paper and less popcorn. And just like in any good show, once the dust settles, there’s always […]