This isn’t just tax preparation. This is a strategic partnership designed to keep more money in your pocket, year after year. Here’s how we transform your tax situation:

Imagine walking into your accountant’s office and discovering you could legally write off your entire work vehicle this year. Not over five years. Not...

Here’s something most people don’t know: when billionaires donate to charity, they’re not just being generous. They’re executing sophisticated tax strategies that can turn...

Have you ever wondered why some people seem to pay hardly any taxes while you’re writing massive checks to the IRS every April? It’s...

Congress just handed you one of the most powerful wealth-building tools in decades, and chances are, your CPA hasn’t even mentioned it yet. The...

Here’s something that keeps me up at night as a CPA: I meet business owners every single day who are unknowingly throwing away tens...

If you’re a successful business owner earning well into six figures, there’s a strong chance you’ve been shut out of contributing directly to a...

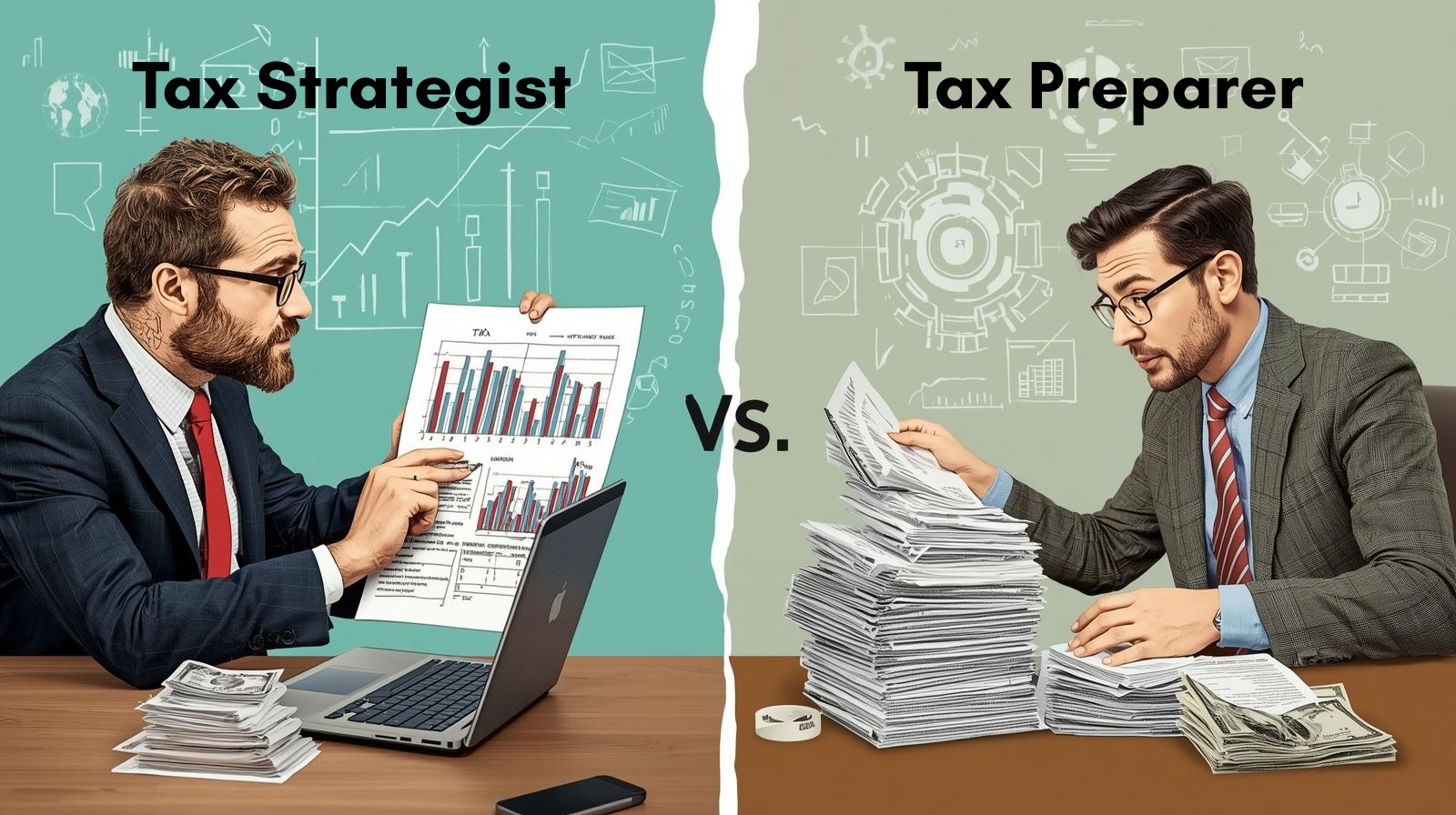

Most business owners work with a tax professional every year—but here’s the problem: they often work with the wrong type of tax professional without...

Why Most Small Businesses Fail (And How to Avoid It) Did you know that 9 out of 10 small businesses fail because of financial...

Most business owners are unknowingly throwing away thousands of dollars each year simply because they chose the wrong business structure. In fact, research shows...

Sometimes the IRS makes announcements that sound small but have big consequences for business owners. That’s exactly what happened on August 7th, 2024, when...

Here’s a question that might make you pause: If I asked you right now to share your profit margin, your current ratio, and how...

For many women entrepreneurs, achieving financial freedom isn’t just about having a successful business—it’s about overcoming limiting beliefs that keep them stuck in a...

Imagine walking into your accountant’s office and discovering you could legally write off your entire work vehicle this year. Not over five years. Not...

Here’s something most people don’t know: when billionaires donate to charity, they’re not just being generous. They’re executing sophisticated tax strategies that can turn...

who i am

You’re smart. You’re successful. You’re building something meaningful. So why do most financial “experts” talk down to you like you don’t understand your own business?

Here’s where that stops. This blog is for women entrepreneurs and business partners who are done with:

What you’ll find here instead:

✓ Actionable tax strategies you can actually implement

✓ Real-world examples from businesses just like yours

✓ Straight talk about what works (and what doesn’t)

✓ Respect for your intelligence and your time

Every post is written with one goal: helping you keep more of what you earn while building the business you deserve. Ready to stop overpaying and start winning? Dive in below.